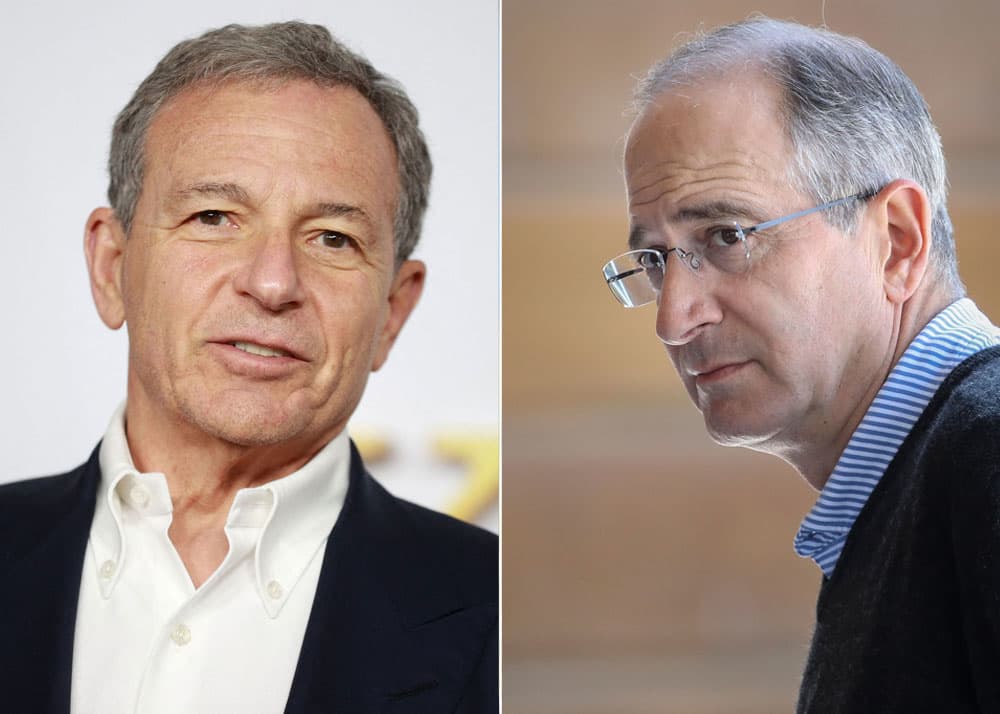

Bob Iger, CEO of Disney (L), and Brian Roberts, CEO of Comcast (R).

Getty Images

Ho, ho, ho! It’s a holiday tradition: Anonymous media executives make their 2025 industry predictions.

In honor of the 12 days of Christmas, we give you 12 predictions from some of the most powerful media and entertainment executives in the world, weighing in on the condition of anonymity so they can speak candidly about their visions of the year ahead. And then, because we have holiday cheer, we give you a bonus one. A baker’s dozen!

Looking back at 2024’s predictions, they were not as good as previous years. But there were some hits, or partial hits.

While Warner Bros. Discovery’s Max, Netflix and Disney didn’t all team up for the first significant streaming bundle, as one participant predicted last year, Max and Disney did join forces. TV broadcast station groups continued to pick off regional sports rights, as another executive anticipated. RedBird Capital didn’t quite acquire Paramount Global, but the private equity firm was part of the consortium with Skydance that announced a merger with the company in July.

As for other 2024 predictions, Nelson Peltz and Jay Rasulo did not win their activist campaign to join the Disney board; Disney CEO Bob Iger did not renew his contract beyond 2026, buy Candle Media or name Dana Walden his successor; and NBA media rights did not go to Disney, Warner Bros. Discovery and Apple — they went to Disney, NBCUniversal and Amazon.

Oh, and one more miss: While Comcast did announce a spinoff of most of its cable networks, it did not spin off NBCUniversal and merge it with Warner Bros. Discovery.

That’s a nice segue to this year’s predictions:

Executive 1: Comcast will acquire the studio and streaming assets of Warner Bros. Discovery and merge them with NBCUniversal

Second time’s the charm! Warner Bros. Discovery is separating its linear assets from the rest of the company. Comcast is spinning out most of its cable networks. It has to mean something, right?

Executive 2: Comcast will acquire Charter and spin off the rest of NBCUniversal

That’s right, Comcast may have SpinCo 1 and SpinCo 2! This executive predicts Comcast will test the Donald Trump regulatory administration and try to combine the two largest U.S. cable companies, 10 years after dropping its bid to buy Time Warner Cable — which used to be the second-largest U.S. cable provider before it was acquired by Charter — after concluding the government would block the deal.

Executive 3: Fox will acquire most of Warner Bros. Discovery’s assets

After selling the majority of its entertainment assets to Disney in 2019, Fox will shock the media world by again gaining scale, acquiring HBO, the movie studio, the Turner networks and the streaming assets of Warner Bros. Discovery, according to this executive.

For what it’s worth, another executive predicted Fox would sell, given the unknown future of the Murdoch family trust.

Executive 4: Dana Walden will leave Disney at year-end when she doesn’t get the CEO job

Disney has already said it plans to delay naming a new CEO until early 2026, so this prediction assumes the company will slightly move up the announcement. Walden, Disney’s co-chairman of Disney Entertainment, is the ultimate Hollywood insider who many view as the front-runner for the job. The board is taking its time vetting candidates after the handoff from Iger to Bob Chapek in 2020 did not go very well.

A second executive posited that NBCUniversal Entertainment and Studios chairman Donna Langley will be considered for the job as a challenge to Walden and other internal candidates.

Dana Walden, Ryan Murphy, Bob Iger, and FX Networks Chairman John Landgraf, from left, attend the premiere of Murphy’s limited series “Feud: Capote vs. The Swans,” on Jan. 23, 2024.

Credit: Disney

Executive 5: Jeff Bezos will be bullied into selling The Washington Post after President Trump makes it clear his space company, Blue Origin, will suffer for his paper’s coverage

Bezos has said he is dedicated to The Post’s future, but the paper has been engulfed in drama this year. Perhaps 2025 is the year Bezos decides he has had enough extra headaches.

Executive 6: Several TV station groups will sell out of financial hardship

Companies such as EW Scripps, Tegna and Sinclair Broadcast have watched their shares slump in recent years as traditional pay-TV valuations have declined with cord cutting. Executives at those companies are hopeful a new Trump administration will clear the way for more consolidation. Several will sell out of desperation, either to avoid bankruptcy or to gain needed scale, guesses this executive.

Executive 7: The Trump administration relaxes TV station ownership rules, leading to CBS, ABC, NBC and Fox buying up their own affiliate stations

A similar thought as the last one, but this executive took the bolder step of saying the acquirers of the stations will be the broadcast networks themselves.

The Paramount Global headquarters in New York on Aug. 27, 2024.

Yuki Iwamura | Bloomberg | Getty Images

Executive 8: Paramount Global will acquire Lionsgate after it spins off from Starz

If Paramount Global gets the government’s approval to merge with Skydance Media next year, its new leadership will likely look to transform the business. One big move the company will make is to acquire Lionsgate studio after it spins off from Starz at the beginning of next year, said this executive.

Executive 9: A big tech company will acquire video game maker Electronic Arts

After flirting with both Comcast and Disney in past years, Electronic Arts will sell in 2025 to a big tech company such as Netflix, Alphabet, Apple or Amazon, said this executive. That would follow in the footsteps of Microsoft acquiring Activision in 2023.

Executive 10: The M&A hype around the industry will be wildly overblown, and there will be far fewer deals than anyone thinks

You’re all wrong! This executive said M&A predictions generally won’t come true because consolidation won’t provide any real fixes to an industry in transition.

Executive 11: Paramount+, Peacock and Max get bundled together

Executives at Paramount Global, NBCUniversal and Warner Bros. Discovery are all on record about needing to consider options for streaming consolidation. What if there was a bundle that featured all three services? This executive guesses the three services will be sold together, either through a hard bundle on one platform or sold together at a discount.

Executive 12: The sports streaming service Venu will never launch, and Fox will license its sports content to ESPN’s streaming service

Venu, a joint venture owned by Disney, Fox and Warner Bros. Discovery, was announced to great fanfare earlier this year. But an antitrust lawsuit filed by Fubo has stalled the service’s launch. Meanwhile, ESPN will debut its “flagship” streaming service by the fall of 2025. That will cause the companies to abandon Venu, predicts this executive.

Executive 13: Kathy Kennedy will depart Lucasfilm

Kennedy has been the president of Disney’s Lucasfilm since 2012 and is now in her 70s. It may be time for a new leader of the Star Wars franchise.

May the force be with you. Let’s see what 2025 brings. Happy holidays!

Disclosure: Comcast owns NBCUniversal, the parent company of CNBC.