The Netflix logo displayed on a phone screen and its website on a laptop screen are seen in this photo taken in Krakow, Poland, June 8, 2023.

Jakub Porzycki | Nurphoto | Getty Images

Get ready to pay more money for Netflix.

You had to read down to page six of Netflix’s shareholder letter to find it. But there it was. One dreaded sentence for price-conscious consumers. One big cheer for investors.

“As we invest in and improve Netflix, we’ll occasionally ask our members to pay a little extra to reflect those improvements, which in turn helps drive the positive flywheel of additional investment to further improve and grow our service,” the company told investors.

Netflix launched its advertising tier in November 2022 as it cracked down on password sharing to give users a cheaper way to access content from the world’s largest streamer. Thus far, not that many people have signed up. Netflix announced earlier this month it has 23 million monthly active users on its advertising tier. That may be 12 to 15 million paying subscribers, estimated Evercore ISI analyst Mark Mahaney.

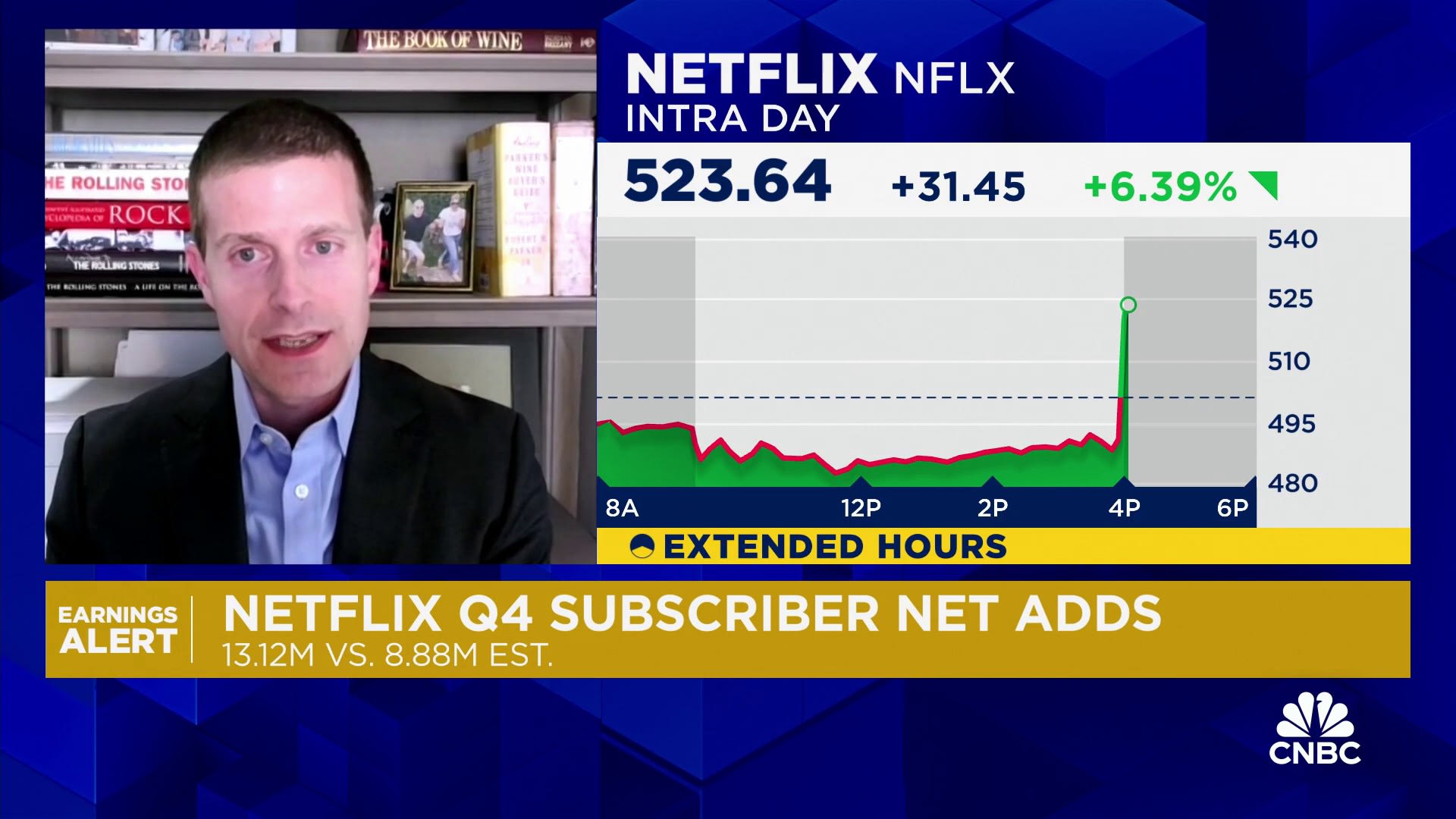

Netflix has more than 260 million global subscribers after adding 13.1 million in the fourth quarter — the company’s largest fourth quarter add ever.

The takeaway for Netflix executives may be that most of its audience is content with paying what Netflix is charging. A standard Netflix subscription in the U.S. currently costs $15.49 per month. The ad tier costs $6.99 a month — the same price at which it launched in 2022.

On Tuesday, Netflix announced WWE’s Raw would come to the service in 2025. It’s Netflix’s biggest foray into live entertainment yet. Netflix is paying more than $5 billion for 10 years of Raw.

With more content, Netflix may have leverage to convince its users that they should pay more money. The company said it plans to increase its content amortization by a “high single digit percentage year over year,” according to its shareholder letter.

Disney is planning to debut a direct-to-consumer ESPN later this year or in 2025. That product will likely cost far more than Netflix. That will also give the company cover to raise prices, as consumers may view Netflix as an even better price-to-value proposition compared to competitive streamers.

Netflix didn’t announce a price hike in its quarterly letter or say when one is coming.

But rest assured: it’s coming.

WATCH: Strong subscriber growth leads to another strong quarter for Netflix